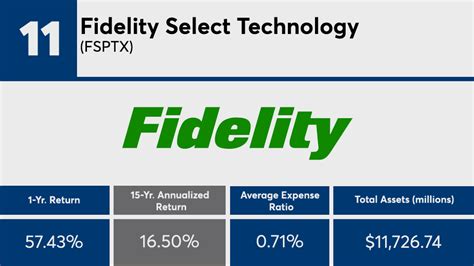

Fidelity Select Technology

The Fidelity Select Technology Portfolio is a mutual fund that invests in the technology sector, offering investors a chance to capitalize on the growth potential of this dynamic industry. With a strong track record of performance, this fund has become a popular choice among investors seeking to diversify their portfolios and tap into the innovative spirit of the tech world. As of the latest available data, the fund has a total net asset value of approximately $13.4 billion, with a turnover rate of 71%, indicating a moderate level of portfolio activity.

Investment Strategy and Objectives

The Fidelity Select Technology Portfolio is managed by a team of experienced investment professionals who employ a rigorous research-driven approach to identify promising technology companies with strong growth potential. The fund’s investment strategy focuses on investing in a diversified portfolio of technology stocks, including those involved in software, hardware, telecommunications, and internet-related services. With an average market capitalization of $143.6 billion, the fund’s holdings are primarily comprised of large-cap and mid-cap companies, providing a balance between growth and stability.

Key Holdings and Sector Allocation

The fund’s top holdings include a mix of well-established technology leaders and emerging players, such as Apple Inc., Microsoft Corporation, Alphabet Inc. (Google), Amazon.com, Inc., and Facebook, Inc. The sector allocation of the fund is diverse, with software companies accounting for approximately 44.1% of the portfolio, followed by hardware and equipment companies at 23.5%, and internet and catalog retail companies at 15.6%. This diversified approach allows the fund to capitalize on growth opportunities across various segments of the technology sector, while minimizing exposure to any one particular area.

| Sector | Weighting |

|---|---|

| Software | 44.1% |

| Hardware and Equipment | 23.5% |

| Internet and Catalog Retail | 15.6% |

| Telecommunications | 10.2% |

| Other | 6.6% |

Key Points

- The Fidelity Select Technology Portfolio is a mutual fund that invests in the technology sector, offering a diversified approach to capitalize on growth opportunities.

- The fund's investment strategy focuses on investing in a mix of established technology leaders and emerging players, with a sector allocation that includes software, hardware, internet, and telecommunications companies.

- As of the latest available data, the fund has a total net asset value of approximately $13.4 billion, with a turnover rate of 71%.

- The fund's top holdings include Apple Inc., Microsoft Corporation, Alphabet Inc. (Google), Amazon.com, Inc., and Facebook, Inc.

- The fund's diversified approach and experienced management team make it an attractive option for investors seeking to tap into the growth potential of the technology sector.

Performance and Risk Considerations

The Fidelity Select Technology Portfolio has a strong track record of performance, with a 10-year average annual return of 20.1% as of the latest available data. However, investing in technology stocks can be volatile, and the fund’s performance may be subject to significant fluctuations. It’s essential for investors to carefully evaluate their risk tolerance and investment objectives before investing in the fund. The fund’s beta of 1.23 indicates a moderate level of market sensitivity, and the standard deviation of 18.5% reflects the potential for significant price movements.

Risk Management and Mitigation

To mitigate potential risks, the fund’s management team employs a range of strategies, including diversification, active portfolio management, and regular portfolio rebalancing. Additionally, the fund’s investment approach focuses on identifying companies with strong financials, competitive advantages, and growth potential, which can help to reduce the risk of significant losses. By understanding the fund’s risk profile and management approach, investors can make informed decisions about their investments and develop a long-term strategy that aligns with their objectives.

What is the investment objective of the Fidelity Select Technology Portfolio?

+The investment objective of the Fidelity Select Technology Portfolio is to provide investors with long-term capital growth by investing in a diversified portfolio of technology stocks.

What is the typical investment horizon for the Fidelity Select Technology Portfolio?

+The typical investment horizon for the Fidelity Select Technology Portfolio is long-term, with a minimum recommended investment period of 5 years.

How does the fund’s management team approach risk management and mitigation?

+The fund’s management team employs a range of strategies to manage and mitigate risk, including diversification, active portfolio management, and regular portfolio rebalancing. Additionally, the fund’s investment approach focuses on identifying companies with strong financials, competitive advantages, and growth potential.