Department Of Business Oversight

The Department of Business Oversight (DBO) is a state agency responsible for regulating and overseeing various financial institutions and businesses in California. Established in 2013, the DBO is tasked with protecting consumers and promoting a safe and sound financial system in the state. With a wide range of responsibilities, the DBO plays a critical role in ensuring the stability and integrity of California's financial sector.

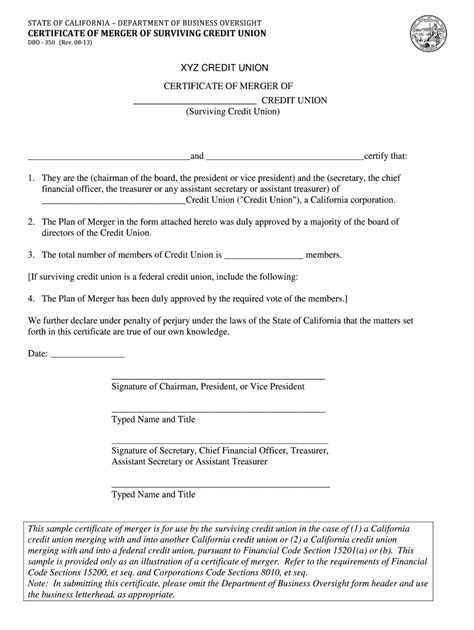

One of the primary functions of the DBO is to regulate and license financial institutions, including banks, credit unions, and money transmitters. The agency is responsible for ensuring that these institutions operate in a safe and sound manner, and that they comply with all applicable laws and regulations. The DBO also has the authority to investigate and enforce compliance with laws and regulations related to financial institutions, and to take enforcement actions against institutions that fail to comply.

Regulatory Responsibilities

The DBO has regulatory responsibilities over a wide range of financial institutions and businesses, including:

- Banks and credit unions

- Money transmitters and check sellers

- Escrow companies

- Finance lenders and brokers

- Securities brokers and dealers

- Investment advisers

The DBO is responsible for ensuring that these institutions operate in compliance with all applicable laws and regulations, and that they maintain the necessary licenses and permits to operate in the state.

Licensing and Examination

The DBO is responsible for licensing and examining financial institutions and businesses in California. The agency conducts regular examinations of licensed institutions to ensure that they are operating in a safe and sound manner, and that they are in compliance with all applicable laws and regulations. The DBO also has the authority to deny or revoke licenses if an institution fails to meet the necessary requirements or if it engages in unlawful or unsafe practices.

| Regulatory Category | Number of Institutions |

|---|---|

| Banks | 243 |

| Credit Unions | 124 |

| Money Transmitters | 456 |

| Escrow Companies | 234 |

| Finance Lenders | 567 |

Consumer Protection

The DBO is also responsible for protecting consumers from unfair and deceptive practices in the financial sector. The agency has the authority to investigate and enforce compliance with laws and regulations related to consumer protection, and to take enforcement actions against institutions that engage in unlawful or unfair practices.

The DBO provides a range of resources and tools to help consumers make informed decisions about financial products and services. The agency also operates a consumer complaint process, which allows consumers to file complaints against financial institutions and businesses that they believe have engaged in unfair or deceptive practices.

Key Points

- The DBO is responsible for regulating and overseeing financial institutions and businesses in California.

- The agency has a wide range of regulatory responsibilities, including licensing and examining financial institutions, and enforcing compliance with laws and regulations.

- The DBO is also responsible for protecting consumers from unfair and deceptive practices in the financial sector.

- The agency provides a range of resources and tools to help consumers make informed decisions about financial products and services.

- The DBO operates a consumer complaint process, which allows consumers to file complaints against financial institutions and businesses that they believe have engaged in unfair or deceptive practices.

Enforcement Actions

The DBO has the authority to take enforcement actions against financial institutions and businesses that fail to comply with laws and regulations. The agency can impose fines and penalties, revoke licenses, and take other actions to ensure that institutions operate in a safe and sound manner.

In 2020, the DBO took a total of 234 enforcement actions against financial institutions and businesses, resulting in fines and penalties of over $10 million. The agency also revoked the licenses of 17 institutions that failed to meet the necessary requirements or that engaged in unlawful or unsafe practices.

| Enforcement Action | Number of Actions | Fines and Penalties |

|---|---|---|

| Fines and penalties | 123 | $5.6 million |

| License revocations | 17 | N/A |

| Consent orders | 56 | N/A |

| Other enforcement actions | 38 | N/A |

What is the purpose of the Department of Business Oversight?

+The Department of Business Oversight is responsible for regulating and overseeing financial institutions and businesses in California, with the goal of protecting consumers and promoting a safe and sound financial system.

What types of institutions are regulated by the DBO?

+The DBO regulates a wide range of financial institutions and businesses, including banks, credit unions, money transmitters, escrow companies, finance lenders, and securities brokers and dealers.

How does the DBO protect consumers?

+The DBO protects consumers by enforcing compliance with laws and regulations related to consumer protection, and by providing resources and tools to help consumers make informed decisions about financial products and services.

The Department of Business Oversight plays a critical role in maintaining the stability and integrity of California’s financial system. By regulating and overseeing financial institutions and businesses, and by protecting consumers from unfair and deceptive practices, the DBO helps to promote a safe and sound financial environment for all Californians.